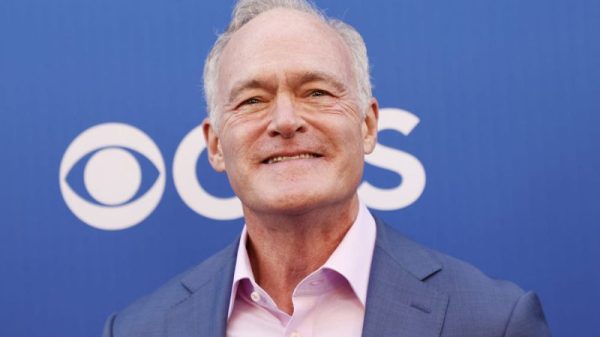

‘We are in a different market now — and this market now is not being driven by futures, it’s being driven by metal,’ he said, explaining that this new dynamic is giving gold’s gains more durability.

While that doesn’t mean there can’t be corrections, he sees a tension in the industry that’s drawing gold higher.

Weiner also discussed silver’s path forward, noting that unlike gold it doesn’t have central bank demand in its corner.

He described silver as the working man’s monetary metal, saying it’s tough for it to take off when many members of the working class are still struggling with persistent inflation and other economic issues.

Silver could benefit if the working class starts faring better, but there are other ways it could move too.

‘The capital-owning class tends to own gold, (but) if they decide owning silver is a relative bargain — the other cliche is that silver is a much smaller market. It wouldn’t take nearly as much buying of silver to really make the price go bonkers,’ he said. For now it’s too soon to tell — Weiner also noted that past price moves don’t guarantee future performance.

Watch the interview above for more of his thoughts on gold and silver. Weiner also shares his perspective on current hot-button issues like the US election and the latest American bank failure.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.