Investcorp Aims for Up to $550 Million in China Yuan Fund

Bahrain-based alternative asset manager Investcorp has set its sights on a groundbreaking venture, aiming to secure 2 billion to 4 billion yuans (equivalent to $274 million-$548 million) for its inaugural private equity fund denominated in the Chinese currency. This strategic move is part of Investcorp’s broader initiative to delve into buyout opportunities within the thriving Chinese market.

Navigating Regulatory Waters: Investcorp’s Yuan Fundraising Plan

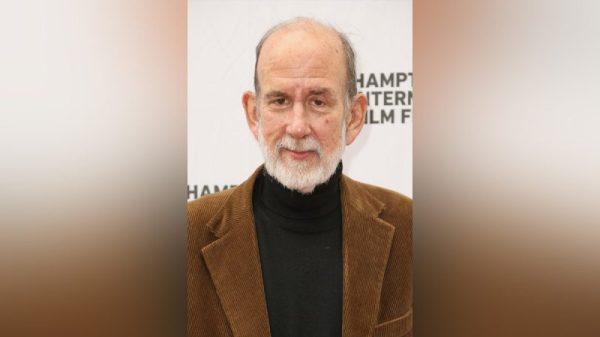

Investcorp’s Co-Chief Executive Officer, Hazem Ben-Gacem, revealed the company’s plan to seek approval from Chinese regulatory bodies in the coming months. The approval would pave the way for Investcorp to commence fundraising activities from domestic institutions starting next year. The timing aligns with the growing business collaborations between the Middle East and China, fueled by the Gulf states’ investments in infrastructure, technology, and finance, against the backdrop of escalating Sino-US geopolitical tensions.

Gulf States’ Growing Influence: A Yuan Capital Source

Investcorp foresees the Gulf region becoming a significant source of yuan-denominated capital. As bilateral trade agreements between Middle East countries and China involve transactions settled in local currencies, there is an increasing pool of renminbi (yuan) within the Gulf Cooperation Council.

Middle East-China Deals: A Momentum Shift

Investcorp’s move follows a notable surge in acquisitions of Chinese targets by buyers from Gulf states. Data compiled by LSEG indicates 13 acquisitions announced in the current year alone, marking a stark increase compared to the preceding year. This momentum includes Investcorp’s milestone, a controlling stake acquisition in Shandong Jianuo Electronics for approximately $100 million. Noteworthy transactions also involve Aramco’s 10% stake purchase in Rongsheng Petrochemical and CYVN Holdings’ $738.5 million equity investment in electric car maker NIO Inc.

Navigating Challenges: Yuan Funds Amid Economic Headwinds

While Investcorp’s ambitions align with a growing trend of funds denominated in Chinese currency, challenges linger. Tensions between China and the US and uncertainties in China’s economic recovery have prompted US investors to exercise caution in deploying new capital in the country. This caution adds a layer of complexity to fund managers’ efforts, like Investcorp, to raise dollars for China-focused funds.

Despite this cautious climate, some private equity and venture funds are actively pursuing yuan-focused initiatives. Notably, yuan-denominated capital raised by China-focused venture funds in 2023 amounted to $7.5 billion, representing a decline from the previous year. Additionally, no China-focused buyout funds have been raised this year.

Investcorp’s Yuan Odyssey in the Chinese Market

Investcorp’s strategic move to establish a yuan-denominated private equity fund signals a bold step into the dynamic Chinese market. The Gulf region’s increasing yuan reserves present a promising capital source, fostering closer economic ties. As the geopolitical landscape continues to evolve, Investcorp’s yuan-centric approach positions the asset manager at the forefront of financial exploration in the ever-expanding Chinese business landscape. The journey unfolds, and the yuans pave the way for a new chapter in Investcorp’s venture into the heart of China’s economic opportunities.

The post Investcorp Aims for Up to $550 Million in China Yuan Fund appeared first on FinanceBrokerage.