Data center demand is not slowing down in the world’s largest market centered in northern Virginia, executives at Dominion Energy said Thursday.

Dominion provides electricity in Loudoun County, nicknamed “Data Center Alley” because it hosts the largest cluster of data centers in the world. The utility works closely with the Big Tech companies that are investing tens of billions of dollars in data centers as they train artificial intelligence models.

“We have not observed any evidence of slowing demand from data center customers across our service area,” Dominion’s chief financial officer, Steven Ridge, told analysts on the company’s first-quarter earnings call.

Wall Street has speculated that the tech sector might pull back investment in data centers as President Donald Trump’s tariffs make it more difficult to source parts and raise the risk of a recession. The emergence of China’s DeepSeek AI lab sparked a sell-off of power stocks earlier this year as investors worried that its model is more energy efficient.

Dominion has 40 gigawatts of data center capacity in various stages of contracting, Ridge said. Data center customers have not paused spending on new projects in Dominion’s service area and they have not shown any concerns about economic uncertainty, Dominion CEO Robert Blue said.

“We’re seeing continued appetite for additional data center capacity in our service territory,” Blue said. “They want to go fast, they always want to go fast. That’s their business, that’s always been their business. We’ve been effective at serving them thus far. I don’t see any reason why that’s going to change in the future,” he said.

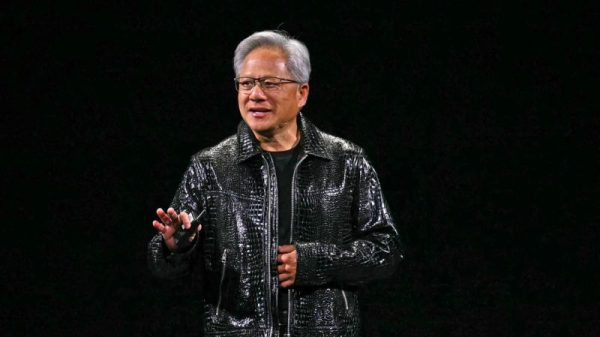

Executives with Amazon and Nvidia said last week at an energy conference in Oklahoma City that data center demand is not slowing. Dominion shares rose about 1% in Thursday trading as the utility maintained its full-year operating earnings guidance of $3.28 to $3.52 per share.