Charles “Mr. Flip It” Hill’s $9.4M Real Estate Scam

At a Glance:

Charles Todd Hill, known as “Mr. Flip It,” was convicted in 2023 for fraud, impacting 18 properties and causing nearly $9.4 million in losses;

Hill funded his lavish lifestyle using investors’ money meant for home renovations, severely misrepresenting his expenses and intentions;

Sentenced to four years in jail plus 10 years of probation, Hill must also pay $9.5 million in restitution;

Experts advise thorough vetting of property deals, expecting budget overruns, and legal safeguarding against fraud;

Santa Clara’s DA underscores the severe consequences of fraud in Silicon Valley’s real estate, emphasising strict accountability.

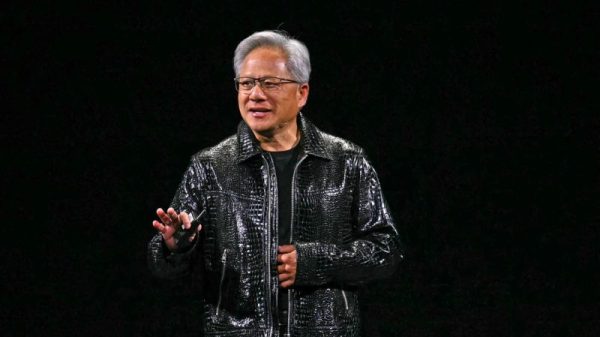

Charles Todd Hill, once a celebrated house flipper and HGTV star known affectionately as “Mr. Flip It,” has found himself on the less glamorous side of the law. His journey from television charm to a Santa Clara County Jail cell is a sordid saga of deceit and mismanaged trust. Hill’s conviction in 2023 for a host of charges, including real estate fraud, financial fraud, and grand theft, marked a pivotal downfall for the former media darling, whose fraudulent activities began to unravel in 2013. Residing in the upscale Los Gatos, Hill’s criminal activities extended over a decade, during which he masterminded multiple schemes that collectively bilked investors of nearly $9.4 million, impacting 18 properties and 11 victims who suffered severe financial and personal losses.

Hill’s Playbook: Ponzi Schemes and $250K in Burnt Promises

Hill’s operation was a textbook white-collar crime: Ponzi schemes, money laundering, and gross misrepresentation. He promised to purchase homes for renovation and resale but instead redirected investor funds to finance his lavish lifestyle. The latter included luxury cars, foreign vacations, and exorbitant partying. These activities were egregiously listed as ‘construction costs’ in his falsified accounting records.

One of the most egregious instances involved an investor handing over $250,000 to refurbish a home, only to find the property reduced to a burnt shell, untouched by promised renovations. Meanwhile, Hill squandered the funds on high living expenses across San Francisco’s most luxurious spots.

Charles Hill’s Punishment: 4 Years Plus $9.5M in Fines

In 2023, after years of investigations, the law caught up with Hill. He was sentenced to four years in Santa Clara County Jail followed by a strenuous 10-year probation period, during which he must also manage the daunting task of nearly $9.5 million in restitution payments. This sentence reflects the severity and extended impact of his fraudulent actions on the victims and the real estate market in Silicon Valley.

Expert Tips to Dodge Frauds like Hill’s $9.4M Scam

In light of such scandals, experts like Beau Eckstein, with over two decades in residential and commercial financing, advise potential investors to brace for budget overruns and extended timelines. Eckstein suggests that rehab budgets typically exceed initial estimates by at least 25%, and rehab durations often double the initial timeline. He also emphasises the importance of involving knowledgeable brokers and legal professionals to handle documentation and review security interests meticulously.

Prosecutor Oanh Tran, reflecting on the case, advises individuals to run title insurance reports when entering monetary transactions with a lien as collateral. She also recommends checking for civil judgments against persons using tools like Santa Clara County’s website portal. These steps are crucial for safeguarding against fraud.

District Attorney’s Stance

Santa Clara County District Attorney Jeff Rosen conveyed a stern warning regarding the case. He highlighted the dual nature of business opportunities in Silicon Valley’s booming real estate sector. Rosen noted that while some view it as a business opportunity, others see it as a criminal opportunity. He emphasized that legal authorities would hold such individuals strictly accountable.

Investing Post-Hill: Vigilance Against Real Estate Scams

This harrowing story of Charles Todd Hill is not just about the fall of a once-revered TV personality. It also serves as a critical lesson for all potential investors in real estate. The allure of quick profits and the glamour of flipping houses are enticing. However, they can quickly spiral into a nightmare if due diligence and legal safeguards are not strictly followed. A reminder is crucial as the Silicon Valley real estate market continues to evolve. Investors should remain vigilant. They should also be sceptical and thorough in their dealings to avoid the pitfalls that befell the victims of “Mr. Flip It.”

Investing in real estate, particularly in areas like Silicon Valley, is undeniably attractive. However, this investment is fraught with risks. These risks require careful navigation and informed decision-making. The saga of Charles Hill, from fame to infamy, is a cautionary tale. It resonates deeply with the need for ethical conduct and rigorous oversight. This is especially true in the high-stakes world of real estate.

The post Charles “Mr. Flip It” Hill’s $9.4M Real Estate Scam appeared first on FinanceBrokerage.