Big Tech’s Earnings: 8% Growth with Nvidia Leading

Quick Look:

Nvidia’s Remarkable Growth: Revenue up to $22.1 billion from $6.1 billion, fueled by AI chip demand;

Apple’s Challenges: Decline in iPhone sales and China market troubles impacting revenue;

Digital Advertising Dynamics: Meta grows while Alphabet struggles; Amazon’s ad revenue rises 27%.

As we delve into an eventful earnings season, Big Tech companies like Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), and their peers are at the forefront of investor attention. The spotlight this season is not only on their financial performances but also on their strides in monetising generative AI technologies. According to Alex Smith from Canalys, a collective growth rate of about 8% is anticipated among these technology giants, with Nvidia expected to lead by a significant margin.

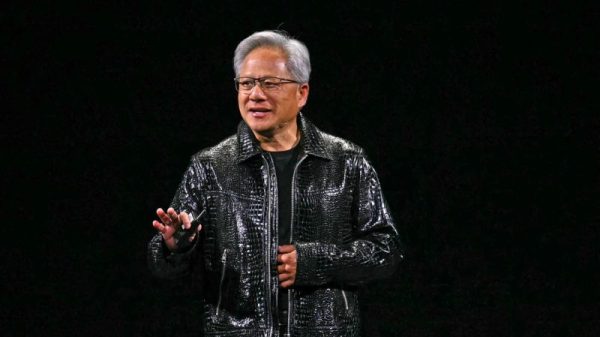

Nvidia: Spearheading Growth with Generative AI

Nvidia stands out this season, showing exceptional growth thanks to its pivotal role in the generative AI revolution. Its stock has seen an astonishing rise, up approximately 75% year-to-date and 225% over the past twelve months. This surge is driven by the high demand for AI chips from major tech firms like Google, Microsoft, Amazon, and Meta, eager to harness AI technology’s power. In the fourth quarter, Nvidia’s revenue skyrocketed to $22.1 billion, a stark increase from $6.1 billion in the previous year, highlighting the immense market demand and Nvidia’s capability to supply the necessary infrastructure for AI advancements.

Apple: Navigating Tech Stocks

Apple, on the other hand, faces a more turbulent season. The company has encountered several challenges, including antitrust lawsuits and declining sales in China, one of its critical markets. Recent reports from IDC indicate that global iPhone shipments have dropped nearly 10% in the current quarter, which could significantly impact Apple’s revenue. The previous quarter saw a 13% decrease in revenue from China, compounding the issues faced by the tech giant. As investors and analysts watch closely, Apple’s strategies to overcome these hurdles and stabilise its market position will be crucial.

The Broader Landscape: Meta and Alphabet

Shifting the focus to the digital advertising realm, Meta and Alphabet are set to reveal insights into the industry’s health. While Meta managed to increase sales in the previous quarter, Alphabet fell short of expectations, highlighting the volatile nature of the digital advertising market. This quarter, it is imperative for Alphabet to improve its performance and meet market forecasts. Additionally, other companies like Amazon are also making significant inroads in the advertising sector, with the e-commerce giant reporting a 27% year-over-year increase in advertising revenue, suggesting a robust growth trajectory that could bolster its financial outlook.

This earnings season is pivotal for Big Tech. Generative AI is the main focus, along with other significant challenges. Companies such as Nvidia are excelling due to the high demand for AI technology. Meanwhile, Apple faces operational and market difficulties. Investors are eager to see how these tech giants can convert AI hype into real profits. Moreover, they are watching how these companies adjust to wider economic and competitive pressures. Indeed, this season will clearly highlight these technologies’ future path and global impact.

The post Big Tech’s Earnings: 8% Growth with Nvidia Leading appeared first on FinanceBrokerage.