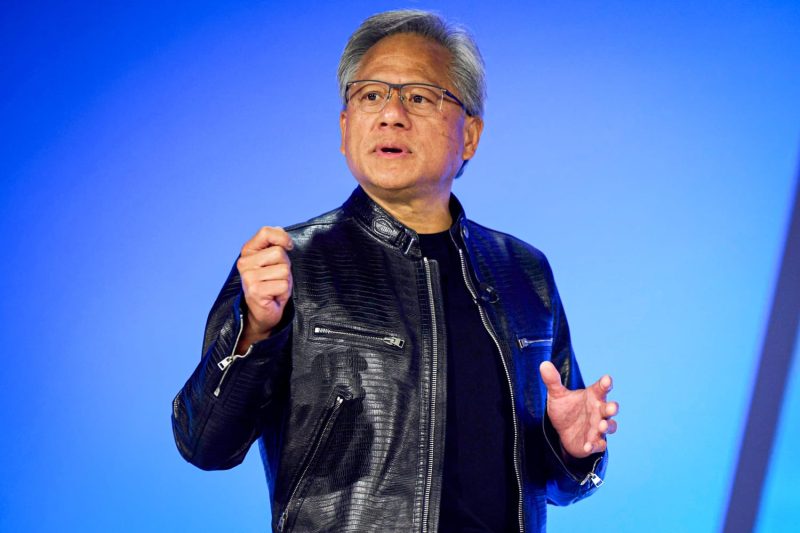

Five years ago, Nvidia CEO Jensen Huang owned a stake in his chipmaker worth roughly $3 billion. After Thursday’s rally, which pushed the stock to a record, his holdings now stand at more than $90 billion.

Nvidia late Wednesday reported first-quarter earnings that topped estimates, with sales jumping more than 200% for a third straight quarter, driven by demand for artificial intelligence processors.

Huang also delivered a better-than-expected forecast and indicated to investors that the company sees insatiable demand for its AI graphics processing units, or GPUs. The company signaled its customers, especially the big cloud companies, could get a strong return on their investment in the pricey chips.

“We are fundamentally changing how computing works and what computers can do,” Huang said.

Huang owns about 86.76 million shares of Nvidia, or more than 3.5% of the company’s outstanding shares. With the stock rising over 9% to close at a price of nearly $1,038 per share on Thursday, the value of his stake rose by about $7.7 billion.

Nvidia shares have more than doubled this year after tripling in 2023. They are up about 28-fold in the past five years. Huang added shares to his stake in 2022, when the stock hit relative lows before the AI boom.

Huang, 61, founded the Silicon Valley company in 1993 to build GPUs for 3D gaming. While gaming was the company’s biggest business for decades, Nvidia has dipped into other markets, including cloud gaming subscriptions, the metaverse and cryptocurrency mining chips.

But Nvidia’s fortunes shifted dramatically in late 2022, when OpenAI released ChatGPT, opening up the concept of generative AI to the broader public. The technology showcased a future in which computers won’t just retrieve new information from databases, but can also generate new content and answers to questions from large caches of unsorted data.

OpenAI does most of its AI development on Nvidia GPUs. As other companies such as Microsoft, Google and Meta bolstered their investments in AI research and development, they needed billions of dollars worth of the latest AI chips to build out their models.

Huang has been the face of Nvidia and its principal salesperson, constantly extolling the potential and power of using the company’s GPUs for building AI.

Nvidia, which has been developing AI software and tools for more than a decade, ended up in prime position to become the top supplier to the biggest technology companies. The company now has about 80% of the market for AI chips, and Huang is among the 20 richest people in the world.