Disney Stock Set to Soar

Quick Look

Bob Iger’s return to Disney heralds a strategic shift, eyeing a 20% stock uptick.

Disney’s focus on park experiences and streaming innovations drives growth.

Bank of America boosts Disney’s rating, projecting robust park and subscriber gains.

Strategic cost-saving targets align with operational efficiency efforts.

The company’s future vision emphasizes innovation and asset optimization for growth.

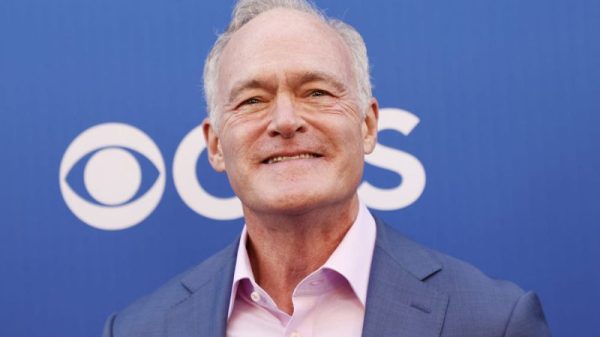

In the bustling realm of entertainment and media, The Walt Disney Company (NYSE: DIS) emerges once more as a beacon of innovation and growth. With the return of Bob Iger to the helm, the entertainment titan embarks on an ambitious journey, rekindling its magic with a strategy poised to unlock unparalleled growth. As Disney positions itself for a staggering 20% upside potential, we delve into the transformative forces at play, spearheaded by Iger’s visionary leadership.

The Iger Effect: Steering Disney Toward Uncharted Horizons

“Bob Iger now appears to be in command and control and on a growth offensive,” remarked a Bank of America analyst. Consequently, this illuminates the renewed vigour with which Iger has taken to navigating Disney’s vast empire. Under his astute leadership, Disney is charting a course through the dynamic entertainment landscape. Specifically, it is focusing on innovation, strategic partnerships, and operational excellence. Furthermore, the bank’s reinforced “Buy” rating and an uplifted price target of $145 from $130 underscore the confidence in the company’s trajectory under Iger’s stewardship.

Moreover, the robust performance of its parks and experiences segment is central to Disney’s resurgence. “Park performance remains robust, and we project operating income to grow in the low-mid teens in F2Q,” Ehrlich highlighted. Importantly, this sector, a cornerstone of the company’s portfolio, continues to exemplify the company’s unmatched capability in creating immersive, unforgettable experiences for its global audience.

Streaming Success and Strategic Synergies

A pivotal element of the company’s growth narrative is its strategic pivot in the streaming domain. Following a landmark carriage deal with Charter, Disney is poised to see a surge in Disney+ net subscriber growth. This partnership, which offers some Charter customers Disney+ access at no additional cost, is a testament to Disney’s agility in adapting to the evolving media consumption landscape.

Ehrlich anticipates a robust addition of seven point five million new subscribers during the quarter, a move that will not only bolster Disney’s streaming arsenal but also set the stage for its operations to reach profitability by the fourth quarter. This is in line with the company’s targeted $seven point five billion in cost savings, a strategic manoeuvre aimed at enhancing operational efficiency and financial performance.

Beyond the Horizon: Disney’s Future Unfolds

As the company continues to navigate through a period of strategic revitalisation, attention focuses on Iger’s battle. He is fighting with activist investor Nelson Peltz for board seats. This struggle highlights the crucial importance of the company’s upcoming annual shareholder meeting. However, beyond these immediate corporate battles, there’s a broader vision for Disney’s future.

Ehrlich’s analysis offers a vivid picture. It shows Disney vigorously harnessing its “collection of best-in-class premier assets.” This effort is to fuel its growth engine. On one hand, the enchanting allure of its theme parks captivates many. On the other, the compelling narratives of its film and streaming services engage audiences worldwide. Consequently, Disney is meticulously crafting a future. In this future, innovation, storytelling, and strategic foresight merge. Together, they create extraordinary value for its stakeholders.

Under Bob Iger’s visionary leadership, the company’s journey is noteworthy. It is not just navigating the waters of the entertainment industry. Instead, it is setting sail toward a future filled with growth, innovation, and unmatched excellence. Through a strategic plan that leverages the best of Disney’s assets, the magic kingdom is on the brink of a new era. It is poised to unlock a new chapter of growth and prosperity. Thus, it affirms its status as a beacon in the global entertainment landscape.

The post Disney Stock Set to Soar appeared first on FinanceBrokerage.