Brent Cook thinks 2024 will be a better year for gold, but what’s working in the meantime?

‘Drill results still work,’ he said at the New Orleans Investment Conference. ‘But what’s surprising, and what I think the real opportunity is right now, is there’s a lot of companies that have solid deposits that work at these metal prices, they make money. And … they’re cheap. So I’m looking actually higher up the food chain than I normally look.’

He’s interested in companies with high-quality deposits as they are likely to become takeover targets for majors. That means assets that have high margins, are permittable and are in good jurisdictions with strong infrastructure.

He mentioned Finland-focused Rupert Resources (TSX:RUP,OTCQX:RUPRF) as an example, saying, ‘They’ve got an open-pit deposit that’s running in the order of 2.5 grams, I think it’s about 3 million ounces. That’s something a major company is going to want to buy in my opinion. And you can get it for probably a third of what the real NPV is right now.’

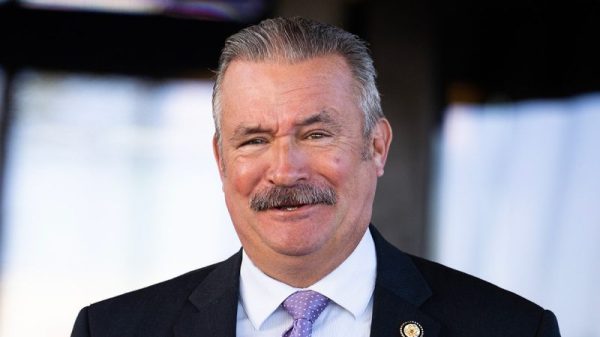

Cook is an economic geologist as well as the founder of Exploration Insights, which he now runs with Joe Mazumdar. Although he’s not usually an optimist, he said he thinks the precious metals sector is ‘bouncing along the bottom.’

‘I do think we’re at a changing point in the gold price, and hopefully that filters down to the mining companies,’ he said.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.