FBS Registration: Building Transparency and Confidence

The 21st century is, among other things, the age of online trading. It is made possible due to modern technology and the abundance of devices that allow you to perform a ton of tasks wherever you are. You’re a few taps away from buying clothes, paying bills, getting a taxi, or opening a trading position at any moment.

In this article, we’ll focus on FBS Indonesia, one of the most popular brokers in the country, and delve into the company’s registration procedure, services offered, and customer support.

Introducing FBS

FBS is a licensed worldwide broker with over fourteen years of experience and multiple international awards. The company is recognized in more than 150 countries across Europe, Asia, South America, and the Middle East. With over 27 million customers and 500,000 partners, FBS is one of the world’s leading FX/CFD companies.

Started in 2009, today FBS is a global fintech brand that unites several companies that represent it and offer online trading services to customers worldwide. Each FBS-related company operates under a local license. So FBS is authorized to provide financial assistance in each region of presence.

As a regulated online broker, FBS strives to provide the best online trading experience. Account protection, data security, top-notch fund management solutions, and convenient deposit/withdrawal procedures are at the core of FBS.

Trading Conditions

Over the years, FBS has maintained high standards of brokerage services. According to the company, its philosophy and approach is to open a gateway to the markets for everyone.

Online trading should be affordable, transparent, and versatile. FBS trading conditions are tailored with that concept in mind. They are designed to meet various trading preferences, styles, and budgets.

The key trading offerings by FBS include:

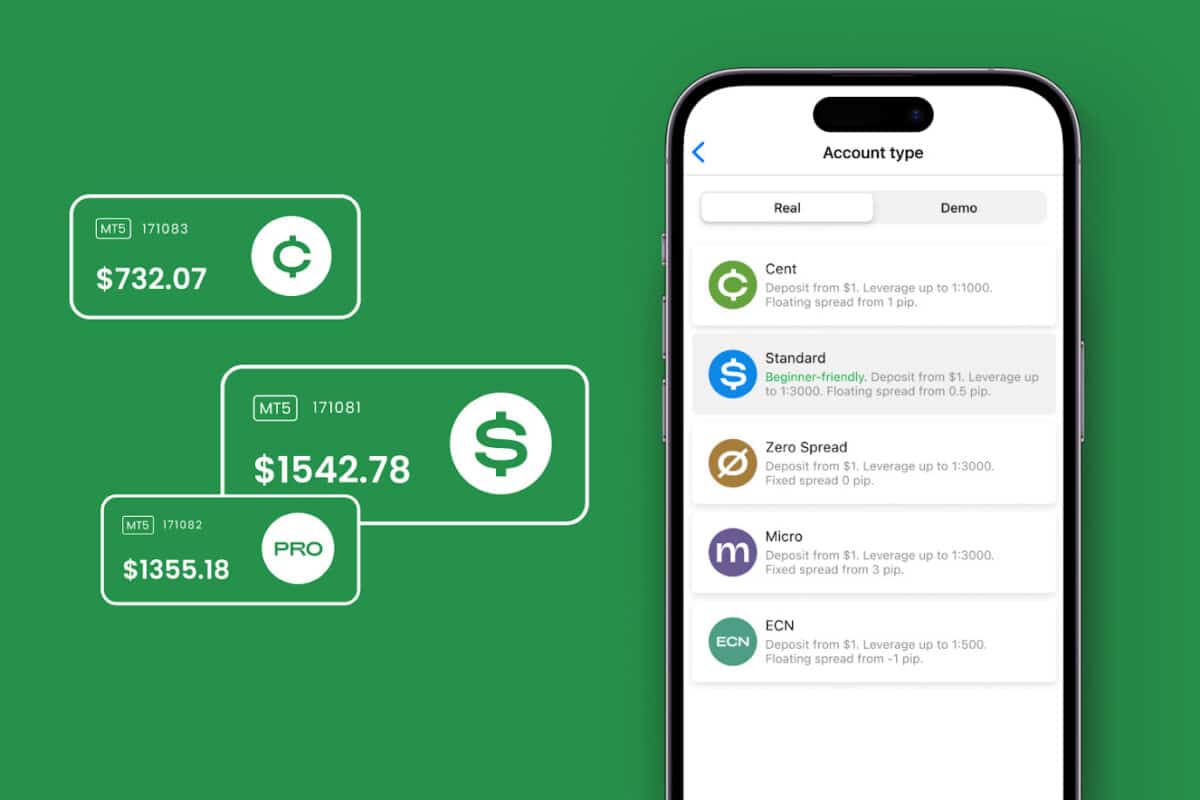

Three types of trading accounts (Standard, Cent, Pro).

Zero commission.

Low fees.

Leverage of up to 1:3000 (depending on the account).

Narrow spreads (0.5 pips).

Fast order execution.

Segregated bank accounts for fund protection.

Free training content.

24/7 multilingual customer support.

Trading with FBS is available via the company’s original mobile software, the FBS Trader app.

Is FBS safe in Indonesia?

FBS is safe to work with, as one can tell by the statistics in Indonesia and overall performance in other countries of presence. FBS operates legally in over 150 countries worldwide, with several independent brokerage companies under the CySEC, Belize FSC, and ASIC licenses.

How to register at FBS

The FBS registration process is straightforward and takes several minutes.

1. Go to the App Store or Google Play

You will need to install the FBS – Trading Broker application to create an account.

2. Install the FBS – Trading Broker app

Press the Get button in the App Store or Install if it is Google Play. Wait for the installation process to finish.

3. Begin registering in the app

Double-tap to open the app and press Registration at the bottom of the screen.

4. Choose how you want to register

You can register with FBS via a social network, or by entering the required data manually. Click Sign up with email if you decide to register manually. Remember to read the Customer Agreement and Privacy Policy carefully before starting the registration process.

If you register manually, type in your email and full name, and press Register.

5. Check the information

Carefully look through all the data on the screen. The system has generated a temporary password for you. We strongly recommend you change it and create your own password. After you are done, press Complete registration.

6. Choose an account

Before you begin to trade online, you must choose an account type. FBS offers a variety of accounts to any taste. FBS Real account or FBS Demo account: it’s up to you.

7. Adjust settings for your account

You can set the parameters for the trading platform, account currency, and leverage here. If needed, you can change some of them later. When you are all set, press Create account.

8. Save the important information for your account

Make sure you save your passwords and keep them in a safe place. You will need your account number, trading password, and trading server for MetaTrader 4 to start trading. When you check all the information, press Proceed to Personal Area.

9. Take security measures (optional)

On this page, you will see additional security settings. For example, you can set a PIN to ensure only you can open the app. This step is optional; if you want to do it later, press Skip in the top right corner.

10. Your registration is complete

Now you are ready to conquer the markets! You can log in to your FBS account anytime. To do that, go to the FBS – Trading Broker app and hit Log in. You can also log in to your Personal Area with the same account at fbs.com.

11. Make sure to confirm your email

You must confirm your email to get access to more advanced operations. To do that, go to your mailbox, open a confirmation email from FBS, and hit I confirm. If you do not get the email, you can request it to be resen anytime or contact FBS support for help.

How to choose an account

FBS offers three different account types. They are Standard, Cent, and Pro. As the names suggest, each account type is designed for a specific experience level.

You might want to go with Cent if you’re in for moderate trading. Standard is your choice for a traditional market experience. Pro is the account for those with enough skills and budget.

The accounts differ in instrument types, margin call values, leverages, etc. For more info, you can visit the official FBS Trading Accounts page.

FBS: a customer-focused business

A regulated broker, FBS operates legally in over 150 countries.

FBS is accessible – any trader can contact the broker via social networks, email, or the 24/7 support team. FBS trading conditions are transparent, and the commission system has no hidden fees or overpayments. Other conditions include leverage of up to 1:3000, low spreads, fast order execution, and easy withdrawals with the country’s most popular payment systems.

FBS offers three types of trading accounts for various trading styles and budgets. Combined with over 650 instruments, it provides a wide range of trading solutions.

The post FBS Registration: Building Transparency and Confidence appeared first on FinanceBrokerage.